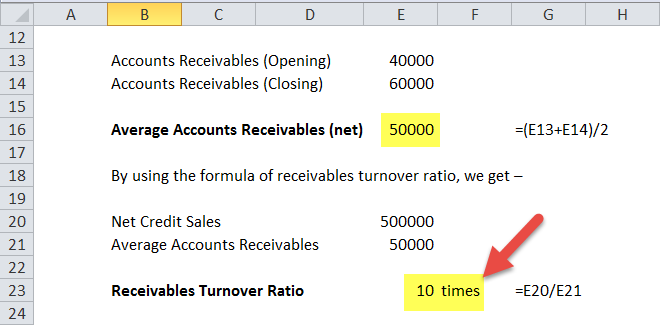

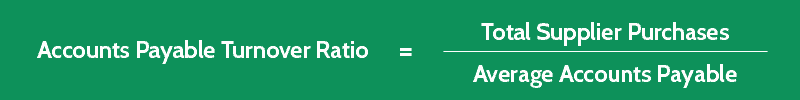

It helps gauge whether a business’ payment policy is conservative or aggressive. The main objective behind calculating days payable outstanding is to check a company’s cash flow and improve its operational efficiency. Measuring the average number of days a business takes to pay back its suppliers helps gauge if a company is making optimum use of its cash position. WHY IS IT ESSENTIAL TO TRACK A BUSINESS’ DAYS PAYABLE OUTSTANDING?ĭPO is a critical efficiency ratio that is used in cash cycle analysis. By calculating APTR, the investors can gauge a company’s ability to meet its short-term obligations, and creditors can measure whether to extend a line of credit to the company. Ideally, a business has to generate enough revenue to clear its AP quickly but not so soon that it misses out on opportunities because it could have used that money to invest in other endeavours. It indicates how many times a company pays off its AP during a period. To convert this to average AP days, simply divide 365 by your TAPT.ĭPO = 365/16.5 = 22.1 days WHY IS CALCULATING THE AP TURNOVER RATIO IMPORTANT?ĪPTR is a short-term liquidity measure that quantifies the rate at which a business pays off its suppliers. This indicates that your company’s AP turned over 16.5 times in the past year. The total purchases for the past year came out to $9,530,000. The AP Turnover Ratio Formula: TAPT = Total Supply Purchases / ĮAP = Ending accounts payable TAPT = Total Supply Purchases ÷ ((Beginning AP + Ending AP) ÷ 2)įor example, if your company had a beginning AP balance of $550,000 at the start of the year and the ending AP balance was $601,000. To calculate the TAPT, you need to combine all purchases made from your suppliers during a particular accounting period, then divide that value by the average accounts payable during the same period Here’s the formula to calculate DPO: DPO = 365 ÷ TAPT

Accounts payable turnover formula how to#

HOW TO CALCULATE DAYS PAYABLE OUTSTANDING?Ī DPO of 25 means that, on average, it takes a business 25 days to pay back its vendors or suppliers. DPO can provide you with critical guidance in balancing your AP & AR processes. The finance department uses this metric to measure how many days the establishment takes to settle its bills.

It is usually compared with the average payment cycle of the industry to gauge a company’s payment policy.

The average time (in days) that a business takes to pay off its creditors is measured by days payable. Businesses that rely on lines of credit benefit from a higher AP ratio as their vendors and suppliers use that metric to gauge the risk they were to take.ĭays Payable Outstanding (DPO) is a measure of the time taken by a business to pay off its suppliers or vendors. Low AP ratios suggest that your company is struggling to pay its bills or that you are using your cash strategically. A higher AP ratio indicates that your company pays its bills in a shorter period. Total AP turnover ratio (TAPT) quantifies how efficiently your business pays the vendors – it shows the number of times the business pays off AP during a specific period. Want to know more about Accounts Payable? Check out our ultimate guide and optimize payables for your business. ACCOUNTS PAYABLE: EVERYTHING YOU NEED TO KNOW Calculating AP correctly yields accurate information about your business’ net worth and a complete picture of how your liabilities and assets are distributed. Like other liabilities, AP affects your balance sheet by offsetting your assets to determine your total net worth. When you pay down the AP, the cash balance also gets reduced to the corresponding amount. Accounts Payable represents a business’s unpaid expenses, and as AP increases, so does the cash balance.

0 kommentar(er)

0 kommentar(er)